What you need to know about mutual fund fees

RECENTLY, THERE HAS BEEN a lot of marketplace chatter about mutual fund fees – what they are and how much they cost. You may have seen a crop of TV commercials that ask why they even exist in the first place. Raising questions is a good thing. The more investors know, the more empowered they are to get the value they seek from their portfolios.

This year, investment account statements have started providing more information on fees, but the new level of detail might raise more questions than it answers. If you are looking for clarity on what you’re paying for (and getting in return), here is an overview of the industry players plus a mini-guide to fees.

Who’s who

To understand the world of mutual funds, let’s start with the different roles and how they work together.

Investor: An investor is anyone, such as yourself, who commits capital with the expectation of financial returns. You utilize investments such as mutual funds in the hopes of growing your money. About 40 per cent of Canadian households – from first-time investors to long-term savers – rely on mutual funds to save for the future.1 Mutual funds give you access to professionally managed, diversified portfolios of stocks, bonds and other securities on a scale that would be expensive and time-consuming for an individual investor to achieve.2 Since many investors don’t have the expertise to navigate through a growing range of options, they turn to an advisor.

Advisor: An advisor provides guidance and manages your portfolio to help you reach your financial goals. Once an advisor develops your financial plan, he or she works with a dealer firm to buy and sell securities for your portfolio.3 Advisors are compensated in a number of ways, depending on the type of services and products they provide and the specifics of each particular investment situation. The best way to find out how your advisor is paid is to ask.

Dealer firm: Dealers sell mutual funds to investors, and may also maintain their investment accounts. Dealers may provide services either directly to you or through your advisor. Annually, your dealer will provide a statement that details the money they received from you over the previous year for these services. Additionally, your dealer firm works to ensure your advisor meets government rules and regulations.

Fund manager: A company that oversees securities. The fund manager oversees the operation of investment funds, including deciding which securities to purchase, and in what quantities, and when to buy and sell the securities. These decisions are based on the stated objective and strategy of the fund. An investment fund offers investors a wider selection of investment opportunities, management expertise and lower investment fees than investors could access on their own.4

A mini-guide to fees

Some fees listed in this year’s more detailed account statements include:

Account charges – charges you pay to the dealer. Account charges are not new but some statements will now present them in two categories:5

- Charges related to servicing your account – charges for services provided to you by the dealer and/or your advisor. Program fees for fee-based accounts will be included here6

- Transaction charges – the commissions charged by the dealer, if any, for buying and selling stocks, bonds, ETFs or mutual funds for your account6

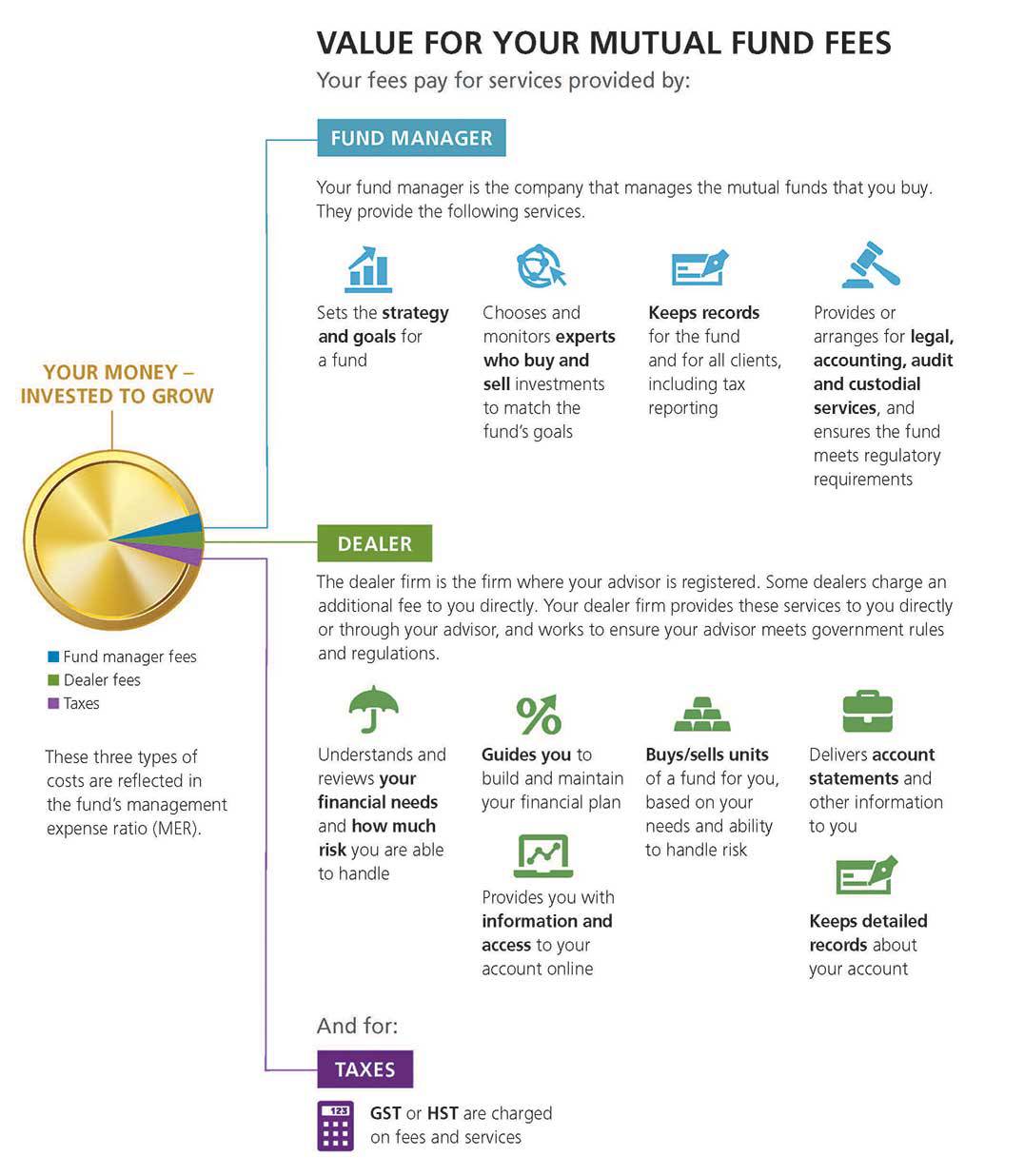

Compensation paid to dealers (often referred to as trailer fees) – what fund managers pay the dealer for ongoing service and advice provided to you by your advisor and the dealer. Dealer compensation is included in a mutual fund’s management expenses. The management expense ratio (MER), which reflects the costs of operating and distributing a mutual fund, is expressed as a percentage of the fund’s average total assets, e.g. 2.1 per cent. In the new reporting, however, you will be able to see the specific dollar amount that you, the investor, paid in trailer fees.

Your statement tells you the amount paid directly or indirectly through your account to the dealer firm, but it does not include the other costs reflected in the MER.

The infographic on the next page illustrates the costs involved with investing in mutual funds. It shows the fees you paid to your dealer, which are shown on your statement, and the services you received in exchange. It also shows the fees you paid to the fund manager, which are reflected in the MER, and the services that fund managers provide.

How can I learn more?

Your best source of information is always your advisor. He or she is your guide to how mutual funds work and what they cost. An informed investor is an empowered investor. Set yourself up for success and speak to your advisor about the cost and value of investing in mutual funds.

1 www.ific.ca/en/pg/investor-centre-glossary/#M 2 www.investopedia.com/terms/m/mutualfund.asp 3 www.ific.ca/en/pg/investor-centre-glossary/#F 4 www.ific.ca/en/pg/investor-centre-glossary/#F 5 www.ific.ca/wp-content/uploads/2016/06/Preparing-CRM2-Reports-for-Your-Clients-A-Guide-for-Dealers.pdf/14300/ 6 “Performance Report Client Guide,” Manulife Securities, 2016.

Important disclosure

This article was originally featured in Solutions magazine © 2017 Manulife.

Manulife Securities related companies are 100% owned by The Manufactures Life Insurance Company (MLI) which is 100% owned by the Manulife Financial Corporation a publicly traded company. Details regarding all affiliated companies of MLI can be found on the Manulife Securities website www.manulifesecurities.ca. Please confirm with your advisor which company you are dealing with for each of your products and services.

Please note that only advisors who are qualified and approved financial planners can provide financial planning advise. Please check with your advisor.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.