Five financial tips to start the year off right

A new year means a fresh start – and a great excuse to refocus on your finances. With pandemic turbulence still causing uncertainty in global markets, it’s a good idea to start focusing on concrete goals, and making a plan you have some control over. Whether you’re saving for retirement, or building an emergency fund, here are a few financial tips to start 2022:

Approach ”bandwagon” investments with caution

If you watched the news in 2021, you’re probably aware of some new (and sometimes quite different than traditional) investments people are putting their money into. Whether it’s the latest crypto currency, a popular meme stock or NFTs, it can be tempting to hop on the latest investment trend for fear of missing out. While some of these investments might be appropriate sometimes it’s impossible to predict because they’re untested and highly volatile. In a time with enough uncertainty, it’s best to focus on putting your money where it can more predictably grow.

Be wary of inflation reducing spending power

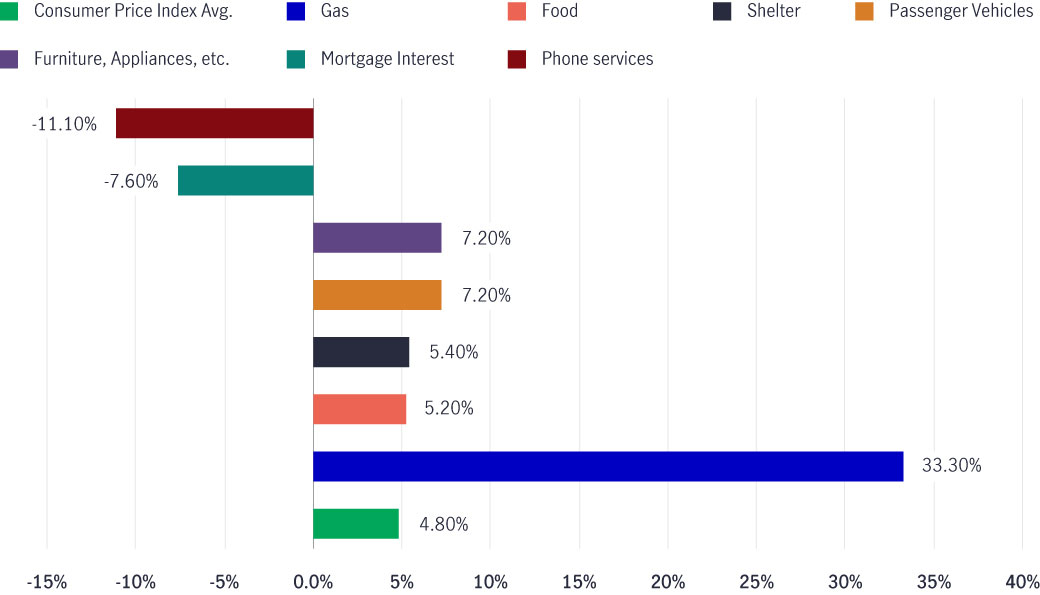

2021 saw massive inflation across a variety of sectors, and even experts can’t agree on if it’s a blip on the radar, or if it’s here to stay. This means that the spending power of your cash is going down, and you need to consider what the best strategy is for offsetting the effects of inflation. If you’re keeping much of your money in cash, inflation will likely outpace any interest you’ll earn. Find opportunities to put your money in stable and reliable investments that can provide return that ease the pain of inflation. To be clear, cash reserved is always warranted for a rainy day - having an easily accessible emergency fund is a key part of any financial strategy. The key for 2022 will be to carefully consider how much money you need in your emergency fund, and shelter the rest from inflation.

Bar chart of the main contributors of the 12-month change in the consumer price index, in percentages. Consumer Price Index Average: 4.80%; Gas: 33.30%; Food: 5.20%; Shelter: 5.40%; Passenger vehicles: 7.20%; Furniture, appliances, etc.: 7.20%; Mortgage interest: -7.60%; and Phone services: -11.10%.1, 2

Tackle your high-interest debt

Especially after the holidays, it can be easy to rack up some debt. But there’s a big difference between a mortgage and credit card debt – the interest rate matters. Many credit cards charge around 20% interest for debt held, which can quickly add up due to compounding interest and make a modest bill daunting. There’s very little chance of any investment you make routinely returning 20%, which should make tackling your high interest debt before putting money elsewhere a very high priority. Take some time to go over what debt you hold, and make a plan to pay off the debt that incurs the highest interest first.

Take advantage of tax season

While not everyone looks forward to tax time, if you’ve been putting money into an RRSP, you might have a reason to. Every penny put into an RRSP reduces your taxable income, lowering your tax bill. There’s still time to make last minute contributions before the March 1st deadline, so it’s a good idea to add money soon. If your employer offers a Group RRSP that can be a great option as generally the fees charged on investments in Group RRSPs are lower.

Prepare for rising rates

Market interest rates are on the rise, and there’s a strong chance that the Bank of Canada begins to raise its policy rate at some point in 2022. This can impact your financial strategy in a few ways. Rising interest rates negatively impact the prices of bonds and make mortgages and lines of credit more expensive to carry. On the other hand, rates on savings accounts and other cash-equivalents like GICs also generally go up with rising rates, making holding cash a little less painful (as mentioned above). Rising rates also have major effects on the economy and financial markets, so understanding how a rising rate environment will impact your financial situation is important so you can plan for it accordingly.

With 2022 already underway, start making your investment plan as soon as possible. And you don’t have to do it alone – work with your financial advisor who can help you strategize for the coming year and create a plan for your individual financial needs.

Important disclosure

Manulife Securities related companies are 100% owned by The Manufacturers Life Insurance Company (MLI) which is 100% owned by the Manulife Financial Corporation a publicly traded company. Details regarding all affiliated companies of MLI can be found on the Manulife Securities website www.manulifesecurities.ca. Please confirm with your advisor which company you are dealing with for each of your products and services.

Manulife Securities does not make any representation that the information in any linked site is accurate and will not accept any responsibility or liability for any inaccuracies in the information not maintained by them, such as linked sites. Any opinion or advice expressed in a linked site should not be construed as the opinion or advice of Manulife Securities. The information in this communication is subject to change without notice.

Please note that only advisors who are qualified and approved financial planners can provide financial planning advise. Please check with your advisor.