Steady hands on the wheel

Twists and turns in the market can mean opportunity for investors who take control.

After a decade of market gain, the volatility that followed the COVID-19 pandemic was unprecedented. While the global financial picture might seem dramatic, this is an important time for the average invest or to review his or her investment strategy.

Short-term market ups and downs can be very unnerving, even if your goals are far in the future. In a recent survey, 94 per cent of the investors who responded said they understood the importance of long-term investment results versus short-term gains. However, 28 per cent admitted they were more likely to sell off investments during periods of market volatility. Only 22 per cent saw volatility as a chance to get ahead.¹

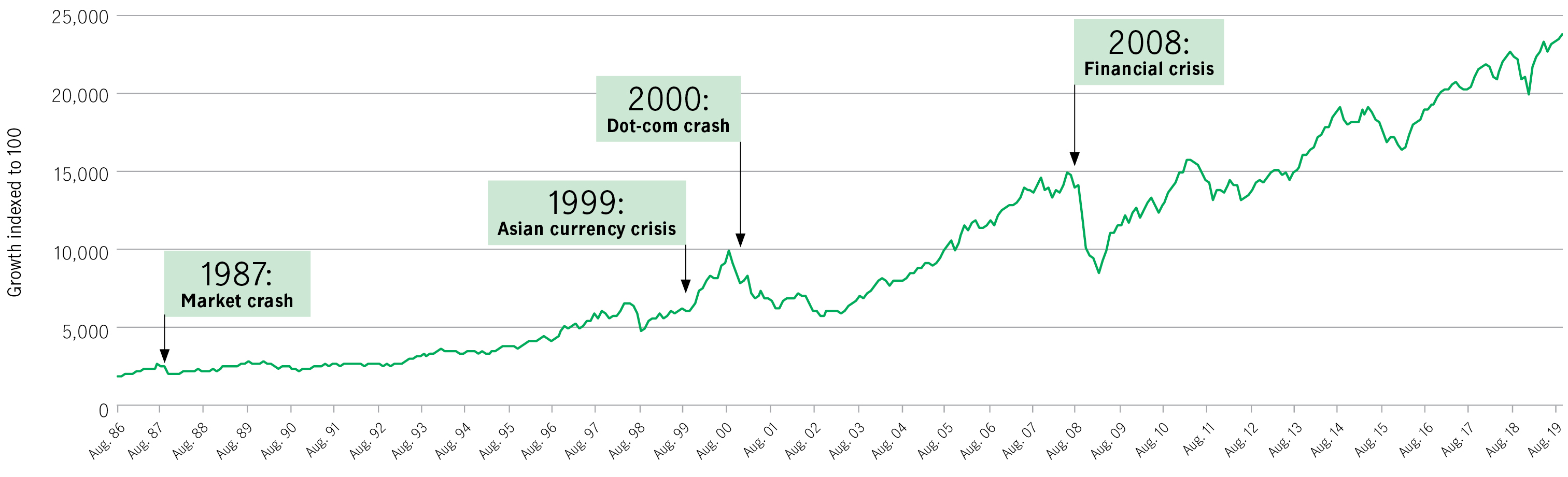

It can be difficult to stay the course when markets are volatile. But keeping your money inactive and out of the markets may actually mean missing opportunities that could help you meet your investment objectives. Cash has a hard time keeping up with inflation, let alone building value over time. And, historically, the moments when investors were most pessimistic about the markets have been among the best times to invest because they have often been followed by market upswings, as demonstrated in the graph below.

Investment choices have broadened over the past decade, giving you and your advisor more flexibility to build a portfolio with growth potential that remains safely within your tolerance for risk. Here are three strategies to consider.

1. Diversify to help soften the ups and downs

Owning investments that tend to rise and fall at different times can help smooth out your returns. The traditional way to diversify has been to mix stocks and bonds in a balanced fund – and that can still be an effective approach for some investors.

In addition, alternative investments are becoming more accessible to accredited investors; diversifying into hedge funds, private equity, real estate, infrastructure, farm and timber lands, and commodities can offer additional levels of risk management. Accredited investors also have the opportunity to benefit from sophisticated strategies used by institutional investors (such as pension plans) – for example, funds that target absolute returns to help control volatility.

2. Consider segregated fund products

In times of volatility, investors often flock to guaranteed products such as bank-offered guaranteed investment certificates. However, other guaranteed options offer greater growth potential – something that’s especially important in the current environment of historically low interest rates.

Segregated fund contracts are a popular choice because they come with a wide variety of underlying investments. Their maturity guarantee and death benefit guarantee offer a guaranteed payment after a contract has been held for a set term and on death, if the contract value at those times is below the guaranteed amount. They can also offer estate planning benefits and potential protection from creditors.

3. Get back into the markets gradually

While you may want to deploy excess cash relatively quickly, you don’t have to invest everything at once. It may be easier to commit to investing smaller amounts on a regular basis – and that’s simple to set up with your advisor. Another reason to take the “gradual” approach with a regular investment plan is the benefit from dollar cost averaging. Essentially, the fixed sums you invest will buy more units when prices are low and fewer units when prices are high, effectively lowering your average cost. When your average cost and providing the potential for greater growth.

Stay focused on your destination

If you were a pilot flying through turbulence, you’d likely make modest adjustments to your altitude to reach less stormy skies. You wouldn’t head outside at 30,000 feet to change the wings on the plane. The same principle applies when investing. Your portfolio may need minor tweaks to keep you comfortable when markets are volatile, but radical changes (for example, shifting too much of your portfolio to cash) could seriously affect your chances of reaching your destination.

The key is to remember why you’re investing in the first place. When you focus on what you want to achieve with your money – whether that’s a comfortable retirement for you, education for your children or any other goal – it becomes clearer which course you should plot through financial market turbulence.

Speak with your advisor about different investment opportunities. Many solutions are available, and he or she can help you identify the ones that will best support your overall goals and financial plan.

Periods of crisis are often followed by periods of market gain

S&P/TSX Composite Total Return Index

Source: Morningstar Direct as at September 30, 2018. For illustration purposes only. Performance histories are not indicative of future performance. The index is unmanaged and cannot be purchased directly by investors. Periods of market crises highlighted on the chart above are not representative of Morningstar Direct.

Need some investing inspiration? Here are some quotes to keep you motivated.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”² – Paul Samuelson, economist, professor and bestselling author

“An investment portfolio is like a bar of soap: the more you touch it, the smaller it gets.” – Investment adage

“In the old legend the wise men finally boiled down the history of mortal affairs into the single phrase – This too will pass.”³ – Benjamin Graham, investor, economist and professor

Staying Invested

A woman jumps onto the couch and turns on the TV

A woman jumps onto the couch and turns on the TV

1 https://business.financialpost.com/pmn/press-releases-pmn/business-wire-news-releases-pmn/market-volatility-exposes-investors-inner-conflict-finds-new-surveyby-natixis-investment-managers 2 www.theglobeandmail.com/globe-investor/investor-education/wise-words-for-do-it-yourself-investors/article17619669 3 Benjamin Graham and Jason Zweig, The Intelligent Investor, revised edition (Toronto: Harper Business Essentials, 2003).

Important disclosure

Important disclosure

This article was originally featured in Solutions magazine © 2019 Manulife.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Subject to any applicable death and maturity guarantee, any part of the premium or other amount that is allocated to a segregated fund is invested at the risk of the contract holder and may increase or decrease in value according to fluctuations in the market value of the asset in the segregated fund.

Please note that only advisors who are qualified and approved financial planners can provide financial planning advise. Please check with your advisor.

Manulife Securities related companies are 100% owned by The Manufactures Life Insurance Company (MLI) which is 100% owned by the Manulife Financial Corporation a publicly traded company. Details regarding all affiliated companies of MLI can be found on the Manulife Securities website www.manulifesecurities.ca. Please confirm with your advisor which company you are dealing with for each of your products and services.